Smart home services outlook: Opportunities vary by country

Ovum analysis: Hurdles to and the outlook for smart home services uptake across the globe vary depending on country-specific conditions and cultural/attitudinal factors.

August 2, 2017

By Michael Philpott

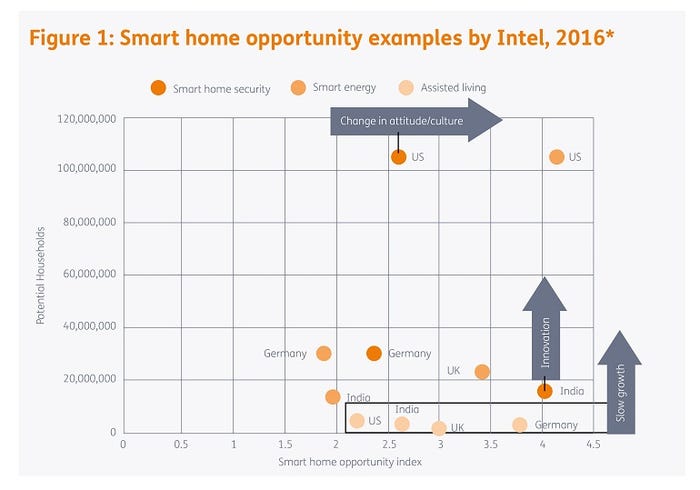

Ovum’s Smart Home Opportunity Index analyzes a number of country-level factors and demographic data points to model the likely opportunity for smart home services within that country. The index not only shows that opportunities differ from one country to the next, but also identifies what is required to grow each opportunity to enable business cases to be developed. In some cases, it comes down to innovation to get around certain hurdles (such as lack of broadband infrastructure or more challenging household demographics), but in other cases it’s an attitude or cultural shift that needs to happen – which, of course, is far more challenging. Innovative marketing can help change such attitudes, but a key ingredient when developing business models in such markets is patience.

Smart home services opportunities differ significantly from country to country

Figure 1 highlights three of the countries, as well as the U.K., analyzed in Ovum’s Smart Home Opportunity Index. It illustrates that the size of the opportunity for each smart home vertical, such as energy, security, and assisted living, can vary greatly from one country to another. This difference is based on both the likely demand for such services and applications, due to certain cultural aspects, and the sheer physical size of the opportunity, due largely to geographical factors and the level of broadband infrastructure deployment.

For example, in terms of potential demand, out of the countries shown, the U.S. presents by far the biggest opportunity for smart home security, both in terms of size of market and level of demand.

This is mainly due to a large existing traditional home security market in the U.S. that smart home players can readily tap into. However, the opportunity for smart energy is lower and behind that of, say, the U.K., although of course the U.K. is still a smaller market from a sheer market size point of view. In the U.K. the cost of energy is relatively high, there is a big push from industry and government around smart meters and improvements in energy efficiency, and in general the population has a good level of knowledge about and a good attitude toward climate change. It’s the combination of such factors that increases the potential for smart energy products within a specific country.

Emerging markets could prove to be great opportunities for smart home vendors

Smart home technology and smart home services is perceived to be very much a developed-market opportunity, and certainly it is countries such as the U.S., South Korea and Hong Kong that have seen the greatest uptake to date. This has led many to dismiss emerging markets as simply not being ready for such products and services. However, as Ovum’s index shows, emerging markets such as India should not be ignored and could be rich potential markets in certain areas, such as smart home security. India is a large country, in which over 85% of homes are owned, the majority of people live in single-dwelling households, and there is a large and growing middle-class segment. The traditional home-alarm market is relatively immature, but fear of burglary is becoming a greater concern as crime rates increase, and it therefore represents a new opportunity for smart home vendors and service providers. The big drawback, of course, is that only 6% of households have a fixed broadband connection. Service providers and equipment vendors will therefore have to innovate around such hurdles to maximize potential.

Patience will be key for many smart home verticals

Growth for some smart home opportunities will rely on a shift in popular attitudes or culture – and such shifts can take time. Service providers looking for “hockey stick”-type growth, therefore, will need to ramp down expectations in these areas if they are to develop a successful business model. Home security in Germany, for example, has always had low penetration (less than 5% of households). Fear of burglary in Germany is increasing, so by creating new, innovative solutions there is certainly potential to grow this market, but it’s clear that it would take a dramatic increase in the fear of crime to quickly push a market from penetration of less than 5% to tens of percentage points.

[Smart Home Summit is where the smart home industry’s savviest players meet to forge partnerships and make the connected home a global reality. Visit the site to learn more about the agenda, speakers and networking opportunities.]

Assisted living is another area that has good potential but will take many years to truly develop. There is demand for assisted living in most countries, with aging populations, urban migration and the desire to live in the comfort of your own home for as long as possible being common traits across many geographies. However, as a proportion of total households the markets are still small, and, having not grown up with digital technology, the current older generation is more resistant to new technology products. The expectations, therefore, are that this market can only grow, but that it will do so gradually over many years. Being able to accurately identify the opportunities and market requirements today, as well as how they will evolve over time, is critical to equipment vendors and service providers alike.

For more information about IoT research and analysis from Ovum, which belongs to the same corporate family as IoT Institute, send email to [email protected].

You May Also Like

.png?width=700&auto=webp&quality=80&disable=upscale)

.png?width=700&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)