Exploring Enterprise IoT Drivers, Challenges and Spend

Ovum's survey finds IoT adoption is still in the early stages for most enterprises and that top challenges cover a wide range of issues.

September 12, 2018

By Alexandra Rehak

To understand what is driving take-up of IoT solutions and applications, it is critical to understand the attitude and intentions of enterprise end users. To this end, Ovum recently conducted a 14-country survey of enterprises that are already deploying or in the process of rolling out IoT solutions. The objective was to examine IoT deployment trends, IoT drivers and challenges, use cases, investment, and technology and provider choices.

Ovum View

Ovum’s survey findings clearly show that IoT adoption is still in the early stages for most enterprises. Fragmentation and immaturity characterize the market. Given the current state of the market, providers must consider who to approach within the organization and be ready to engage in education about IoT solutions, use cases and benefits – it is not just about introducing new technologies to the IT department.

Regional differences are significant in some cases, from technology choices to organizational goals and challenges. But many IoT drivers are universal – organizations are looking for cost savings, greater efficiency and improved competitiveness in the first instance, with sustainability or new revenue growth goals further away for most.

Top IoT challenges cover a wide range of issues, from integration with existing IT and security concerns, to worries over in-house skill sets to support sustainable and scalable IoT deployments. These are not minor concerns, and providers should work to help their customers meet these challenges head-on if they wish to see successful and growing IoT deployments.

Providers should be ready to start small and meet customers where they are. A quick deployment and targeted ‘just do it’ approach to IoT will work better than trying to promote broader strategic approaches, though these can be a useful framework for a longer-term vision.

Most respondents report seeing measurable benefits from IoT deployments in fewer than 12 months; helping customers understand the best KPIs to measure and demonstrate IoT success can help drive further investment. Entering into IoT project discussions armed with this information can maximize the chances of a successful outcome for all parties.

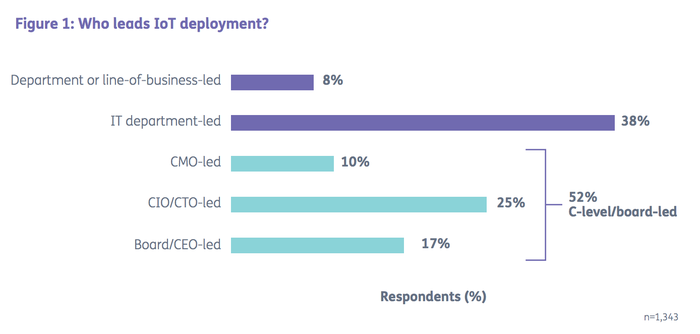

IoT Leadership Starts at the Top

A decision to deploy IoT typically involves multiple stakeholders. Our survey results show that while the IT department is an important stakeholder, enterprise board/C-level leaders are the driving force behind 52 percent of IoT deployments. IoT suppliers must ensure their pitch is understood by senior leaders, which may require more focus on business benefits and less on the IoT technology. To further boost chances of winning a deal, IoT suppliers must also secure buy-in from the head of IT.

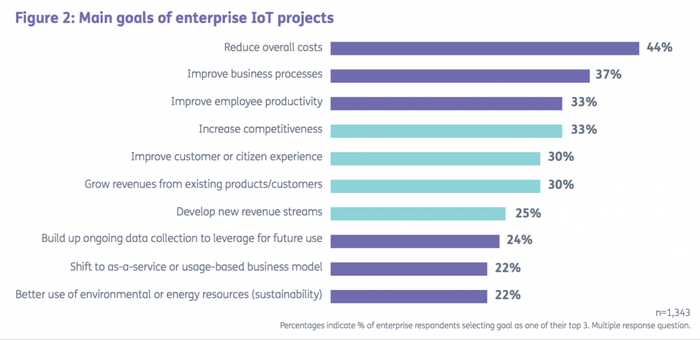

Key Drivers Link to Cost Reduction, Efficiency and Competitiveness

Reducing costs and improving business processes are the top IoT drivers, but a solid one-third of respondents also placed high priority on using IoT to improve competitiveness or customer experience.

As one manufacturer said, “The biggest thing for us, to be honest, is customer satisfaction, which is really driving us as a differentiator. We think deploying this technology can move us up the value chain with customers.”

In this particular case, the manufacturer is using sensor-enabled technology to track the progress and performance of a cleaning device moving through an oil pipeline – a purely B2B application and not what one would think of as a typical use case for improving customer satisfaction. But the IoT data generated by the connected device is being used to understand many other elements besides simply its speed of progress and location. These are then analyzed and fed back to both customer service and sales teams to enable greater insight, more effective service, and a stickier customer relationship.

Building new revenue streams from IoT was important to a minority of enterprise deployers, along with longer-term goals such as sustainability. These goals are still further out for most enterprises, though they play a role in strategic decision-making on IoT deployment.

The key drivers are reflected in the KPIs used by enterprises to measure successful IoT deployments; almost half of enterprises surveyed use productivity and cost savings data as their top KPIs. Enterprises were likeliest to report measurable benefits linked to efficiency or productivity gains, greater asset/performance insights, cost savings, and improved customer satisfaction.

Challenges Center on Security, Costs and Integration

It was not a big surprise to see data and network security concerns topping the list of IoT challenges that enterprises face (see Figure 3). The ongoing cost of sustaining IoT projects is also a key concern for enterprises. Organizations also face headaches over the complexity of integrating IoT with their existing ICT infrastructure and existing business processes.

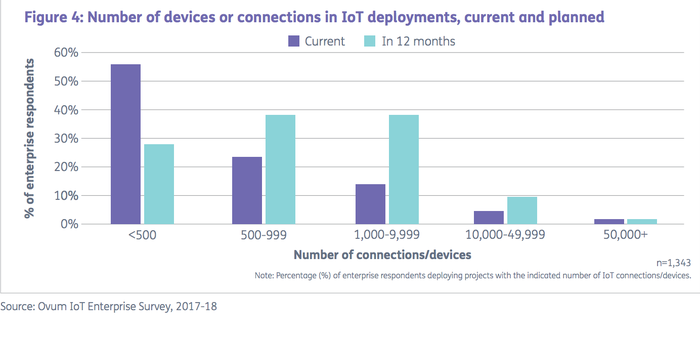

Project Size and Spend Start Small, but Will Increase Rapidly

We asked respondents about the number of connections/devices they were deploying for their IoT projects at the time of the survey, and how that will change in the future, in order to get a better picture of IoT project scale. Figure 4 shows that as of 2H17, 56 percent of enterprise IoT projects involve deployment of fewer than 500 connections/devices. At the other end of the scale, just 7 percent of enterprises surveyed had IoT deployments with 10,000+ connections/devices. In the next 12 months, the size of enterprise IoT projects will shift up; 60 percent of enterprises surveyed expect their projects to support 500–9,999 connections/devices in 2018. China will lead on larger IoT deployments with 38 percent of Chinese enterprises planning 1,000-9,999 connections/devices, followed by 26 percent of enterprises in France and in South Korea.

IoT spend is still low. In 2017, 71 percent of the enterprises surveyed invested less than $500,000 in IoT. In nearly all countries, the largest percentage were investing in the sub-$250,000 range. The clear exception was China, where 53 percent of enterprises fell into the higher $250,000–$500,000 investment band. Germany led in the $5 million+ investment category, with 5 percent of German enterprise respondents investing at this level.

In tandem with the planned increase in the number of IoT connections/devices that enterprises plan to deploy, enterprises also intend to grow their IoT investments in 2018. A total of 29 percent of enterprise IoT adopters will spend more than $1 million on IoT in 2018, up from 12 percent in 2017. German enterprises are the most optimistic with 38 percent of those surveyed planning to spend more than $1 million on IoT in 2018, followed by South African enterprises with 35 percent.

To help enterprises make the most of their planned increased spending on IoT, providers will need a full understanding of the most relevant IoT use cases, technologies, and business models.

For more information about IoT research and analysis from Ovum, which belongs to the same corporate family as IoTWorldToday.com, send email to [email protected].

You May Also Like