Intel to Buy Mobileye for About $15 Billion in Car Tech Push

The chipmaker's acquisition is the largest deal yet for the Israeli high-tech sector.

March 13, 2017

Intel Corp. plans to buy Israel’s Mobileye NV for about $15 billion, its second-biggest acquisition and an expensive attempt to leapfrog rivals such as Qualcomm in technology for self-driving cars.

The U.S. chipmaker will pay $63.54 per share in cash for Jerusalem-based Mobileye, according to a statement Monday from both companies. The offer is a 34 percent premium to Mobileye’s closing price on Friday. The shares surged 29 percent to $61.20 at 9:41 a.m. in New York.

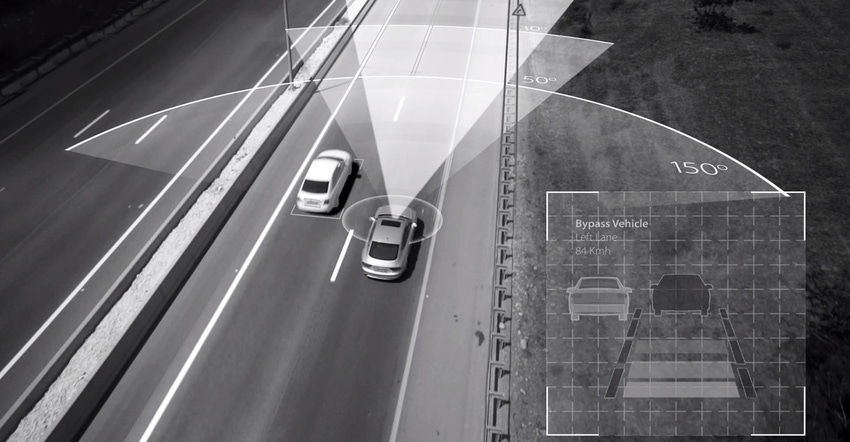

Intel is trying to accelerate a push into what many chip companies view as the next big opportunity: self-driving cars and the data they generate. With Mobileye, Intel gains the ability to offer automakers a larger package of all of the components they will need as vehicles become autonomous. The Santa Clara, California-based company estimates the market for vehicle systems, data and services will be worth as much as $70 billion by 2030.

“They’re paying a huge premium in order to catch up, to get into the front of the line, rather than attempt to build from scratch,” said Mike Ramsey, an analyst with technology researcher Gartner.

While Intel’s chips are dominant in personal computers and data centers, the world’s largest semiconductor maker has struggled to spread the use of its products to other areas where semiconductors based on ARM Holdings PLC. designs have prevailed. Under Chief Executive Officer Brian Krzanich, Intel has sought to break into everything from drones to cash registers. That’s generated a limited amount of new revenue that hasn’t yet fired up Intel’s overall sales growth, and the company still remains reliant on PCs and servers for its profit.

Mobileye is the second-biggest acquisition for Intel after Altera Corp., which it bought in 2015 for $16.7 billion. On a conference call with analysts, Krzanich said the latest deal will immediately add to Intel’s adjusted earnings and cash flow. But the acquisition won’t have much impact on revenue. Last year Intel reported sales of $59 billion compared with Mobileye’s $358 million.

Intel shares slipped 1.5 percent to $35.37 at 10:01 a.m. in New York.

In the highly competitive market of autonomous cars, Intel’s purchase is a shot at rival Qualcomm Inc. The mobile phone chipmaker is in the process of making itself the world’s biggest producer of chips used by the automotive industry through its $47 billion acquisition of NXP Semiconductors NV.

“Intel are so far behind in this space the only way they could catch up was via an acquisition,” said Neil Campling, head of technology research at Northern Trust Securities.

Carmakers and technology companies are scrambling to stake out a leading market position. Intel’s chips are already in 30 vehicle models currently on the road and are being used in hundreds of autonomous test vehicles, the company said in January. Intel and Mobileye had already teamed up with BMW AG and plan to introduce fully autonomous cars by 2021. The companies are dispatching a fleet of 40 self-driving 7-Series sedans this year to hone systems for complex urban traffic.

Alphabet Inc.’s Google has clocked 2 million self-driving miles on public roads, Tesla Inc., has gathered data from 1.3 billion miles of data from Autopilot-equipped vehicles, and Mercedes-Benz parent Daimler AG has partnered with Uber Technologies Inc.

Google, which separated its self-driving car project into a new unit called Waymo, plans to start a ride-sharing service using semi-autonomous minivans made by Fiat Chrysler Automobiles NV as soon as the end of 2017. Volkswagen AG is rolling out Moia, a new division that will focus on ride-sharing and other mobility services. Mercedes already offers cars that can pilot themselves at highway speeds.

Digital mobility services for automobiles will reach almost $2 trillion in 2025 from $860 billion in 2016, according to Sarwant Singh, a senior partner at the global market research company Frost & Sullivan. In an interview earlier this year he attributed much of Mobileye’s success to the fact that it was first in its field.

Intel’s offer represents an equity value of about $15.3 billion and an enterprise value of $14.7 billion, according to the statement.

Intel Chief Financial Officer Robert Swan said the company expects to see $175 million a year in cost and tax savings from the transaction and that these economies would help cover the purchase premium Intel is paying for Mobileye. He said the deal would help boost Intel’s adjusted earnings and free cash flow starting in 2018, the first year after the deal is expected to close.

About the Author(s)

You May Also Like

.png?width=700&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)