Analysis from Ovum maps out trends and recommendations around 4 key IoT vertical markets: connected cars, smart homes, smart cities and insurance.

July 27, 2017

By Alexandra Rehak

This year will bring important IoT advancements in a number of industry vertical markets, including some that up until now have been more in the “IoT development” phase. While organizations within early-adopter industries (for instance, manufacturing and logistics, fleet management, and utilities) have already started to realize significant cost savings and efficiency impact from machine-to-machine (M2M) deployment, IoT initiatives and impact are now gaining momentum in a number of other verticals. Below we examine upcoming trends, and opportunities, for four of these IoT vertical markets: connected and autonomous cars, the smart home, smart cities, and insurance services.

As IoT technologies and applications continue to develop, enterprises and public sector organizations are increasingly becoming aware of the potential benefits of the IoT and are starting to think about how IoT-enabled services fit in with existing business processes and new business models. In many cases, however, there is more “supplier push” than “demand pull” as the market is still in the early stages.

We are seeing significant progress in business-to-business-to-consumer IoT propositions, ranging from smart home to smart cities (both for citizen-facing propositions and city management in areas like public safety and environment), and encompassing connected cars and related telematics-based insurance propositions.

As licensed spectrum low-power wireless access (LPWA) technologies are commercialized, IoT opportunities will extend to more verticals and more new applications. We will see a clearer mapping of which technologies are best suited for specific use cases emerging this year, as well as increased focus on providing enterprise customers with truly end-to-end IoT solutions. This will drive development and take-up of IoT solutions in different verticals.

[Smart Cities Summit is the go-to event for government and technology executives mapping America’s smart cities. Visit the site to learn more about the agenda, speakers and networking opportunities.]

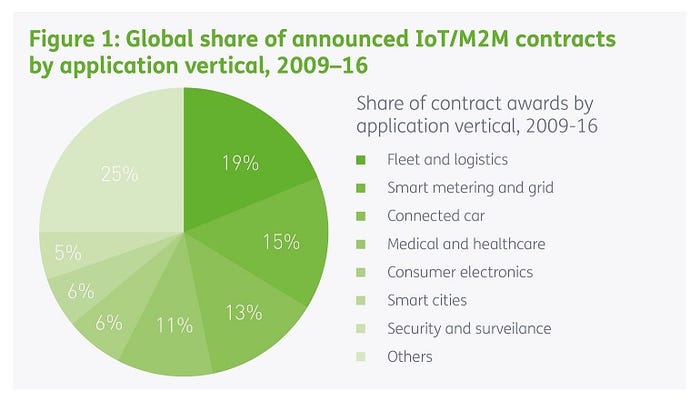

There has been much talk of communications service providers (CSPs) evolving into platform companies, and many now have multiple customers for their IoT platform offerings. But those service providers achieving the greatest IoT success thus far have focused on co-creating IoT solutions for specific enterprise use cases, in specific verticals. Leading CSPs are now really starting to see the positive results emerging from IoT partnering and co-creation efforts that began two or, in some cases, even three years ago. Many have focused on a few specific verticals, as illustrated in Figure 1. Transferring applications and experience from one vertical to another will be a goal for all major market players this year and beyond.

We see the following trends emerging for these four key IoT verticals:

Connected and autonomous cars

Look for an ongoing shift away from providing core car connectivity via tethered smartphones or user-installed broadband devices, to delivering built-in connectivity in new cars; but smartphones will still be an important remote control and authentication interface (and a highly vulnerable one).

The idea of car and home integration is growing, as is that of seamless interoperability between the two environments, and personalization in the car.

In autonomous driving development, the vision is shifting from 100% autonomous driving as a near-to-medium-term goal in itself, to a greater focus on a “zero-accident” world.

Smart home

The smart home market is still largely centered on individual retail products. Providers that know the consumer retail market well are likely to be the most successful – as Amazon is amply demonstrating – while telco-led efforts to deliver integrated devices around their own platforms have thus far shown less value. We expect to see service providers continuing to innovate and experiment as they try to find the right place in the smart home value chain.

Vendors and service providers are embedding voice-activated AI assistants into their individual smart home solutions. Over the next few years, their functionality will increase, going far beyond simple interactions based on commands and actions, and enabling digital assistants to become a key control point for the smart home and the extended smart personal environment.

Insurance

Insurers are now well aware of the IoT and fear the disruptive impact of new offerings such as usage-based insurance, as well as potential new competitors. Many, though, have not yet seriously begun to develop IoT-based offerings. Car insurance providers in the U.S., U.K., Italy and Canada are the leaders thus far. Meanwhile, technology giants and telcos are establishing dominant positions in areas such as smart home and connected cars, which may eventually displace insurers.

On the demand side, consumer appetite for usage-based insurance offerings has been slow to develop. Even in the vehicle insurance market, Ovum’s research indicates that take-up has plateaued at between 2% to 5% of total policies sold. Similarly, life insurers have seen limited adoption, and this has been almost exclusively among already fit-and-active customer segments. It is not yet clear whether low take-up to date reflects limited consumer demand, or whether the issue is more that insurance carriers are not seen by consumers as the natural source for such products.

On the supply side, the difficulty of accurately quantifying the investment needed in this nascent and uncertain market, particularly with competing IT priorities (such as mandatory regulatory compliance requirements), is also delaying things.

In Ovum’s view, the long-term viability of insurance-provider-led IoT offerings is questionable. Partnership strategies will be the best option for many, creating good opportunities for telcos and vendors to work with insurers on usage-based and other IoT-linked insurance offerings.

Smart cities

As smart cities offerings and partnerships evolve in 2017, both service providers and vendors need to consider, and be ready to support, the different ways cities are approaching the “smart journey.” We break these down roughly into “pragmatic patchwork” and “central control” approaches. The former is by far the most common, with individual smart city projects being deployed for specific applications such as smart lighting and smart parking, often with little or no coordination between projects.

Budget constraints and slow decision-making processes, departmental silos, political pressures and the challenge of legacy IT systems are all significant challenges impacting the enthusiastic but generally fragmented approach to smart city development, in most markets.

However, necessity drives creativity, and both governments and providers are keen to find new ways to develop sustainable and coordinated smart city initiatives. Ovum expects to see creative vendor-led and telco-led approaches to smart city financing and public/private business models starting to become more standardized over this year and next.

Recommendations for providers

Connectivity for vehicles is no longer a newsworthy or differentiating feature, but is becoming an essential underlying enabler. At the same time, auto OEMs’ managed connectivity requirements are growing – they now need single-service-provider global connectivity solutions. This opens up new opportunities for innovative mobile network operators (MNOs) and mobile virtual network operators (MVNOs). And, existing auto OEM connectivity arrangements are for current vehicle models only – the partners chosen to enable the next generation of cars should (and most likely will) be different.

Software and technology vendors will have more opportunities as connected cars are increasingly linked with wider, often open, ecosystems – including other manufacturers’ models, roadside infrastructure, cloud-based resources, smart city applications, and aftermarket/in-home hardware and applications. To make this work, auto OEMs require strong software platform partners to provide managed networking services that guarantee data processing and routing. This is a big opportunity for software developers and platform providers that are able to deliver solutions that are “auto OEM grade” (that is, offering very high performance and reliability) – a term long-applied to vehicular components and hardware, which is now being extended to software.

While CSPs may not dominate on the smart home device and platform front, Ovum believes that the smart home still holds significant value for them and can support churn reduction and new revenue objectives. As with other IoT verticals, if telcos are to succeed in making their services or hardware (for example, the home gateway) critical to the successful functioning of the smart home, there has to be a value proposition beyond simple connectivity that hits the mark with consumer end users.

Telcos and technology players targeting the insurance sector should bear in mind that take-up of IoT-based insurance offerings is still low, and appetite for investment from insurers themselves may be muted. Many are still in early stages of considering IoT strategies, despite understanding that the IoT will be massively disruptive for the sector. That said, insurance company partnerships can be an effective way to build out these propositions jointly, particularly in areas like smart home and automotive.

Given ongoing pressures on government spending in most countries, telcos and technology vendors offering smart cities solutions will need to be creative in their approaches to financing what are likely to be long-term relationships with city and government authorities. We note the emergence of innovative contractual solutions for dealing with upfront costs of smart city technology deployments, through as-a-service deals and “opex for capex” swaps. The most successful models can be replicated across multiple cities in a country or region.

Finally, both telcos and vendors should look to build flexible, multilateral partnerships to address IoT-enabled vertical opportunities. In some cases, these may cross or combine several verticals (a la the recently announced smart home/home insurance/security partnership between KPN, Philips Lighting, French insurance firm AXA and French energy company ENGIE). It is still early days for the IoT and vertical ecosystems; there will be plenty of trial and error. Whom to partner with and how far to stretch across the value chain will continue to be important strategic questions, both in the short and longer term.

For more information about IoT research and analysis from Ovum, which belongs to the same corporate family as IoT Institute, send email to [email protected].

You May Also Like

.png?width=700&auto=webp&quality=80&disable=upscale)

.png?width=700&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)