Emerging LPWA IoT market to drive IoT ‘democratization’

LPWA technologies are expected to have a significant, positive impact on the growth of IoT, unlocking its full potential by lowering the cost of embedded connectivity.

July 23, 2017

By Jamie Moss

By 2019 to 2020, LPWA networks–a relatively recent addition to the IoT market, at least in their licensed spectrum variants–will be established worldwide. In terms of average revenue per connection (ARPC), LPWA is likely to be lower than anything we have seen before. But the number of connections and new business models that will be enabled means that LPWA technologies will have a significant, positive impact on the growth of the IoT. LPWA technologies extend the market established by machine-to-machine (M2M) interaction and unlock the full potential of the IoT by democratizing and lowering the cost of embedded connectivity. By 2018 we expect to start seeing see significant numbers of LPWA enterprise contract awards, and the proliferation of application use cases.

Ovum view

Inherent limitations in prior IoT/M2M technologies have left a clear market gap for LPWA IoT technologies. LPWA is designed to enable inexpensive modems that consume very little power. The trade-off is that LPWA is only useful for infrequent and/or low-data-rate communications.

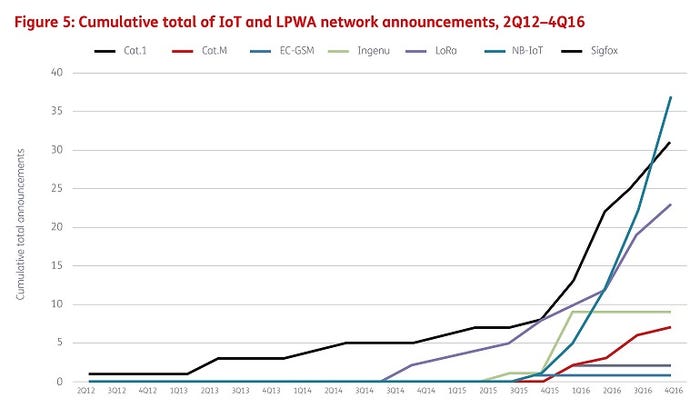

In 2016, LPWA service provider commitment to Sigfox, LoRa and NB-IoT exploded, with a total of 110 LPWA networks launched and announced by the end of the year, according to Ovum’s “IoT & LPWA Network Deployment Tracker” report. NB-IoT accounted for the greatest number, with 38 announcements by the end of 2016. Cat. M (LTE-M) did not experience meaningful levels of support until early 2017, but is gaining traction now in a number of markets including North America, parts of Asia and Europe (where it still lags NB-IoT).

The NB-IoT networks that have launched to date all operate at 800MHz. LoRa, Sigfox and Ingenu all use unlicensed ISM bands. Ingenu is unique in operating at 2.4GHz, while LoRa and Sigfox operate at approximately 900MHz. EC-GSM, Cat. 1, Cat. 0 and Cat. M (LTE-M) use the same spectrum range as their parent GSM and LTE networks.

LPWA networks are being operated by companies with diverse backgrounds. These include established telecommunications network operators, startups, vertical industry service providers and alternative infrastructure owners.

LPWA services are targeted at enterprises looking to deploy IoT applications quickly (and relatively cheaply), and to enable this, in many cases LPWA pricing plans are structured more like tiered consumer mobile plans. Such schemes are easy to understand, quick for small businesses to get onboard with and easy to scale downward, as well as up.

The fact that LPWA is “only” for low-speed connections means it is clearly targeted at the market for simpler, inexpensive and highly numerous IoT devices. LPWA and cellular M2M are complementary technologies and will serve different purposes in supporting the growth of the IoT market.

LPWA network rollouts are ramping up dramatically

NB-IoT, LoRaWAN (LoRa), Sigfox and Ingenu are the most significant LPWA technologies today, based upon the number of public network rollouts announced to date. The first Sigfox network was deployed in 2012 in the company’s home market of France, with Sigfox acting as both network infrastructure vendor and network operator. Over the next three and a half years, a handful of Sigfox and LoRa networks were announced, plus a single public Ingenu network. In 2016, however, LPWA service provider commitment to Sigfox, LoRa, and the newly standardized NB-IoT exploded, and 110 LPWA networks had been launched or announced by the end of the year. A significant number of providers had also announced commitments to Cat. M1 (LTE-M) by February 2017.

With the majority of LPWA network launches being very recent–two-thirds occurring during 2016–the market has not yet had time to fully demonstrate its potential to generate connections and revenue. LPWA technologies are only just starting to be commercialized. The first NB-IoT launch was in October 2016, coming earlier than was expected from Deutsche Telekom in Germany and the Netherlands.

Judging by the split of LPWA networks launched by the end of 2016, it would be easy to assume that Sigfox and LoRa have stolen a market lead over the licensed spectrum LPWA technologies. But to some extent this is an artifact of the way in which the different technologies are deployed. Sigfox and LoRa networks tend to be launched at the same time as, or very shortly after, new service providers are announced. Their networks are deployed locally, city by city, as new business opportunities dictate, gradually progressing toward nationwide mesh coverage–which can take two to three years. But Sigfox and LoRa providers are able to announce their commercial availability as soon as the first locale is covered –or, in some cases, as soon as the first few base stations are deployed. Furthermore, Sigfox operates by selling an exclusive license to a single service provider in each country, which can give a skewed impression of availability and the technology’s popularity, and ergo of its uptake.

By comparison, NB-IoT is an overlay, with a geographic footprint that will match that of the host LTE network. In many cases, NB-IoT deployment is via a software-based upgrade, although in some older networks eNodeBs also need to be replaced. NB-IoT can–and in initial cases is–being switched on regionally as localized business opportunities emerge. NB-IoT can be activated nationwide overnight if an operator wishes; the only barrier to doing so is the cost of each eNodeB’s software upgrade and a reluctance on the part of operators to spend money doing so until they know that they need to.

Delays in the software rollout of NB-IoT have thusfar been caused by the newness of the technology to enterprises as well as the low availability of NB-IoT chipsets, both of which will be resolved by midyear. NB-IoT and LTE-M network announcements were also delayed while the industry waited for the 3GPP standards to be finalized, which happened in June 2016. But they are now coming thick and fast, for both of these licensed spectrum technologies, although NB-IoT maintains a definite “lead” for the moment.

LPWA’s lower costs and different capabilities open up new markets

LPWA use cases will be closely tied to the need for low-speed IoT connections. If a particular IoT application or connection requires greater data throughput, then the connected asset and the data it communicates is likely to be of greater value, justifying the expense of a cellular connection. Instead, LPWA suits applications requiring simpler, inexpensive, highly numerous devices that need to communicate a small amount of information–often event-based information, rather than data streams. In Ovum’s view, LPWA and cellular M2M are complementary IoT technologies rather than substitutive.

Where cost is not an issue for a wireless IoT connection, but mobility and/or battery power are, cellular and LPWA technologies can be combined, with both radios existing in a single chipset. The LPWA radio can be a listening device, which can then, as appropriate, trigger the need to switch on the cellular radio to then initiate a full data session. By putting cellular radios into deep sleep and avoiding unnecessary wake-ups, power savings can be maximized, prolonging battery life.

In terms of ARPC, LPWA may be lower value than anything we have seen before. As one price point, Sigfox devices currently generate between €1 per month and €1 per year for connectivity. However, revenue will still grow, as LPWA IoT devices will be deployed in much greater quantities than earlier-generation M2M devices. LPWA is also likely to eventually be sold in a different way than device-based allowances, with LPWA connectivity sold in bulk as a functional component of greater managed service, designed to provide specific guarantees, quality of service and process outcome.

LPWA lowers the barriers for service provider market entry, attracting companies from once-disparate backgrounds to compete with one another, and offers access to an untapped seam of connectivity opportunities. The LoRa infrastructure market opens up opportunities for both old and new network equipment vendors, while the proprietary Sigfox and Ingenu infrastructure is monopoly-controlled. On the terminal equipment and chipset front, a range of established semiconductor manufacturers produce NB-IoT, Cat. M, LoRa and Sigfox ASICs. At the next layer up, a common suite of established module manufacturers creates components and devices that use NB-IoT, Cat. M, LoRa, Sigfox and Ingenu ASICs. The potential mass adoption of LPWA presents large new revenue opportunities for both.

Recommendations for providers

LPWA network costs may be greater than initially expected. LPWA networks solve specific problems that earlier radio communications technologies struggled with. But they may face new problems of their own. Multiple national LPWA networks using unlicensed spectrum–connecting an order-of-magnitude more devices, often using the same unlicensed spectrum–pose contention and capacity concerns that can only be mitigated through spectrum reuse and more infrastructure rollout. Vendors and service providers need to prevent long-term capital expenditure from undermining the foundational affordability of LPWA connectivity for enterprises.

LPWA service providers may need to subsidize terminal equipment. Faster network deployments, wider availability and lower service costs should mean LPWA allows enterprises to generate the return on IoT investment they need. But all of this is undone if the cost of the terminal hardware is too high. LPWA modem prices need to fall considerably to be affordable, but bulk orders are needed to create those economies of scale. Service providers may need to provide modems for free, at least in the early stages of market development, to simultaneously kick-start orders and facilitate application development.

Service providers should look to spread their bets in IoT network deployment. The IoT is not a technology battleground; it is an arena for the application of that technology that is most appropriate in each use case. Service providers should work with whatever technologies they believe there is a sufficient market for. Infrastructure vendors must provide equipment that seamlessly supports multiple communications and LPWA technologies. Service providers need a toolbox of IoT solutions to serve their customers, rather than aiming for a one-size-fits-all solution.

For more detail on LPWA, see Ovum’s recent report, “Drivers and dynamics for the emerging LPWA IoT market.”

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)